Digital

Culture Code

Even in a rapidly changing digital transformation era, customers remain at the center of financial services. Hana Financial Group’s digital transformation is therefore focused on customer satisfaction. We declared our digital vision in 2018 projecting a customer-centric, data-driven information company, and adopted the “Hana Digital Culture Code”.

-

2017HANA FINANCIAL GROUP DATA CENTER Hana Financial Group built an integrated data center in Cheongna International City, a free economic zone, in 2017.

This is the domestic industry’s first case of integrating the IT infrastructures, technologies and specialists of all Group affiliates in one place. It currently serves as a forward base for Hana Financial Group’s digital transformation. -

2018HANA FINANCIAL GROUP DIGITAL VISION Hana Financial Group declared 2018 as the first year of digital transformation, sharing a vision and roadmap for transformation of all employee mindsets and the organizational culture. We have since been integrating IT into finance, thereby developing new growth engines. In particular, we offer distinctive customer values by collecting all data and market information generated through customer interactions and are moving forward with a customer-centric digital transformation.

Digital

Workforce

Hana Financial Group is focusing on effectively attracting and retaining digital talent, thereby enhancing corporate competitiveness. In addition, we are innovating our methods of working through adoption of digital technology to enable our talent, who will lead platform-based finance, to focus their time and capabilities on work of greater value.

-

2018ROBOTIC PROCESS AUTOMATION Hana TI has developed “Work-Life Bot”, a robotic process automation (RPA) solution optimized for the financial industry, through the engagement with POSCO ICT in August, 2018. By 2020, all Group affiliates have adopted the RPA solution and, in 2021, achieved tangible outcomes in terms of reduced costs and improved productivity.

-

2019HANA GLOBAL CAMPUS Hana Global Campus was opened in May 2019 to foster global and digital talent. At one of the largest training facilities in Korea, employees of Hana Financial Group’s global network, comprising subsidiaries and offices in 24 countries across the globe, are growing into the Group’s core talent.

-

2020DT UNIVERSITY “DT University” was launched in June 2020 to nurture leaders for the Group’s digital transformation. DT University is an integrated training platform providing practical and task-specific digital training through on/offline courses. By nurturing a school of convergent talent armed with financial knowledge and digital skills through DT University, we are strengthening the digital capabilities of the Group.

Digital

Transformation

Based on the digital competitiveness, mindsets, and talent that it has secured over the last several years, Hana Financial Group is implementing its digital transformation at a more rapid pace. To have our financial platforms expand beyond traditional financial areas and thus evolve into a life platform that resolves inconveniences in daily life, we are increasing the scope not only of synergetic collaborations among the Group affiliates but also of cooperation with others. Through such distinctive open digital innovations, we are creating a new chapter in Korea’s history of platform-based finance.

-

2021HANA HAP In November 2021, Hana Financial Group unveiled an integrated MyData brand, an industry first. “Hana HAP”, which reads “one sum” in Korean, offers customer-specific optimal financial service solutions by consolidating customers’ extensive financial data scattered across the digital network of the Group affiliates. It is an outcome of a proactive planning executed at the Group level through organic cooperation among the Group affiliates. Since March 2022, we have been operating a joint office space where business units dedicated to MyData business and IT personnel of three subsidiaries in banking, financial investment, and card, have been working together. They are preparing the launch of non-face-to-face products that are Mydata based and Hana HAP specific.

If our initial task was to collect customer’s asset data scattered across the Group affiliates and to display them in one setting, our next step is to enable wealth management services and product recommendations tailored to individual customer’s preferences and best interest. For this, we will consolidate scattered customer data upon relevant customers’ consent which will enable us to grow beyond traditional financial service boundaries and into a “digital wealth management platform” offering daily financial services to customers.

DIGITAL FIRST,

ASCENDING STRENGTHS.

In the era of digital transformation in which industry boundaries are fast fading, Hana Financial Group is growing stronger by adding digital technology to the traditional strengths it has accumulated as a comprehensive financial group. In addition, we are increasing investments in companies of high growth potential and cooperation with different industries, as a way to discover new growth opportunities beyond collapsing industry boundaries.

beyond banking

-

CREATING A NEW CONCEPT OF CONVENIENT BANKING

IN COOPERATION WITH BGF RETAIL Hana Bank in 2021 launched an innovative digital channel combined of finance and distribution developed in cooperation with BGF Retail. The “Smart Self-zone”, available at some CU convenience stores without a bank or ATM within 500 meters, enables customers to enjoy wide-range of daily-life financial services. Going forward, we will actively explore collaboration opportunities to unveil diverse daily-life financial services and thus provide more convenient and innovative financial services. -

LEADING THE PROPTECH MARKET

IN COLLABORATION WITH JUMP COMPANY Hana Bank signed an MOU on proptech platform cooperation in December 2021 with Jump Company, which specializes in proptech, and agreed to provide commercial real estate-related financial services for the SMEs and individual business users. In line with the rapid growth of the proptech market, we will continue to discover, cooperate with, and invest in, promising startups such as Jump Company. -

BUILDING A NEW INVESTMENT CULTURE

IN PARTNERSHIP WITH NETMARBLE In November 2021, Hana Bank unveiled “Marble of Investment”, jointly developed with Netmarble. The mock investment game service, through which customers can have fun accessing and experiencing information, marks the Bank’s first attempt to develop new business opportunities by targeting digital natives amid expedited digital transformation.

-

NON-FACE-TO-FACE CREDIT LOANS

Hana Bank’s Hana 1Q Credit Loan, launched in June 2019, enables customers to find out their credit limits and get a loan in three minutes. As of the end of 2021, a total of 379,9981) cases of loan were made, amounting to KRW 11,664.6 billion2).

1) Cumulative basis, including loans that were paid back

2) Cumulative basis. Balance at the end of 2021: KRW 5,579.3 billion - AI LOAN SERVICE In 2021 Hana Bank became the first financial institution in Korea to implement AI to determine loan limits by launching “AI Loan” through which customers can check the maximum amount of loan they can borrow with ease. It takes loan applicants less than a minute to find out the maximum loan amount and minimum interest rates they are qualified for, and a mere three minutes to get a loan.

- MOBILE PRODUCT SUBSCRIPTION Hana Life’s mobile app “1Q Life” enables customers to purchase health insurance in less than three minutes. It has substantially simplified the insurance application process by minimizing disclosure requirements and adopting a simple electronic signature system, thus allowing customers to conveniently purchase insurance via a mobile device and review the policy.

Largest global

network in Korea

As of the end of 2021, Hana Financial Group holds 212 global networks across 24 countries, the most extensive in Korea. Leveraging the global reach of our network, we are realizing profitable and solid growth in the overseas channels.

Localization

powered by digital

Behind Hana Financial Group’s 2021 steady growth

in the global market stands its localization strategy.

We are focusing on attracting local customers from a

long-term perspective and building up growth momentum

by expanding platform-based digital finance.

Next step for the future of

global finance

ESG management has become a global trend. In widening the stride of its ESG vision, “Big Step for Tomorrow”, to a global level and in pursuing global growth, Hana Financial Group focuses on ESG factors, thereby developing into a global financial group and realizing a sustainable future through finance.

Empowering

green economy

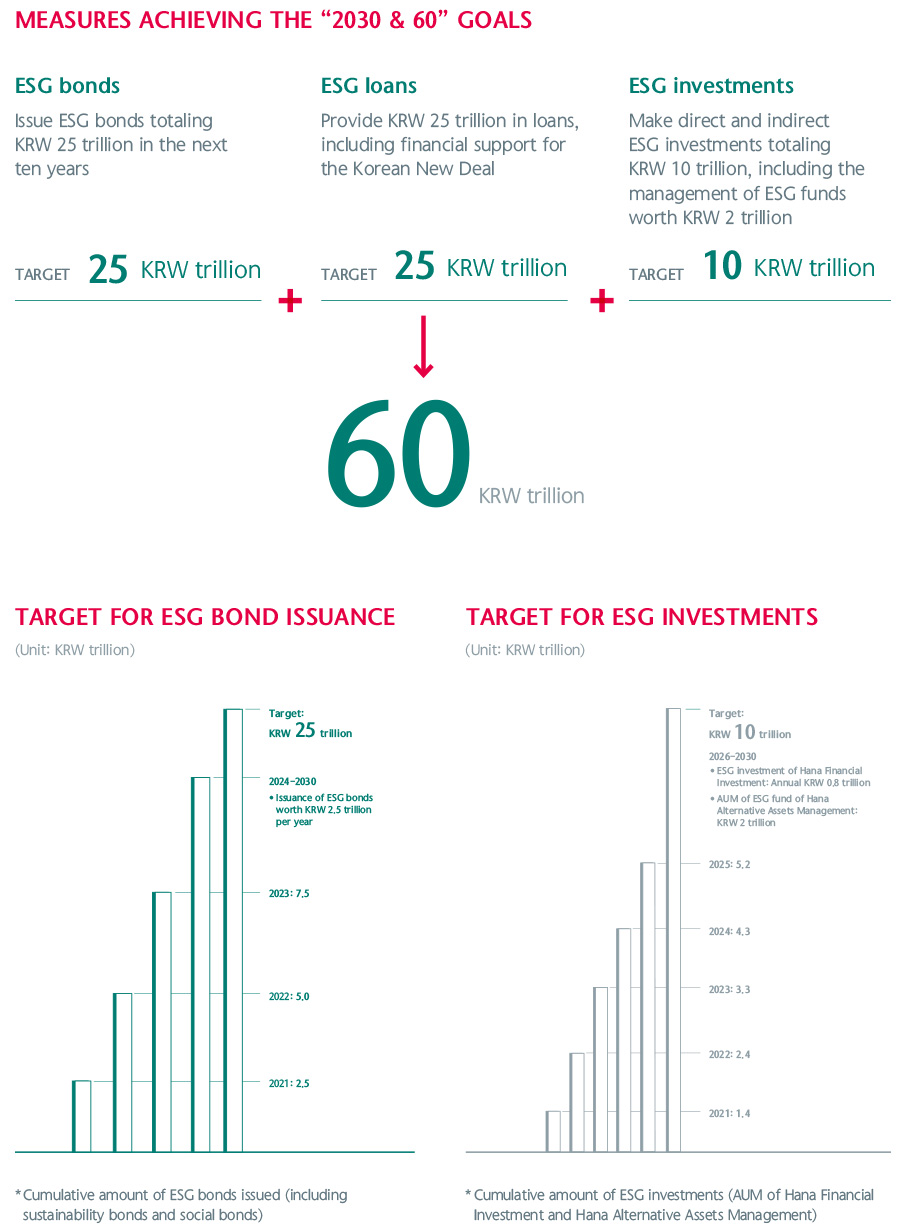

Hana Financial Group declared 2021 as the first year of its ESG management, established an ESG vision, “Big Step for Tomorrow”, and took a new big step toward sustainable tomorrow. In addition, with an eye toward expediting the national transition to a low-carbon economy through finance, we established mid- to long-term ESG goals of “2030 & 60” and “ZERO & ZERO” and announced the steps to take toward the goals.

Geared to

sustainable growth

Hana Financial Group has been practicing sustainable management by aligning

the creation of social and environmental values with its business strategies.

In addition, we have established an ESG governance and are internalizing

ESG management, so that such strategies lead to action. In March 2021, we

created Sustainable Management Committee within the BoD and a dedicated

ESG Team in our efforts to implement ESG management from a more

systematic and long-term perspective, thereby further solidifying our ESG

governance structure.